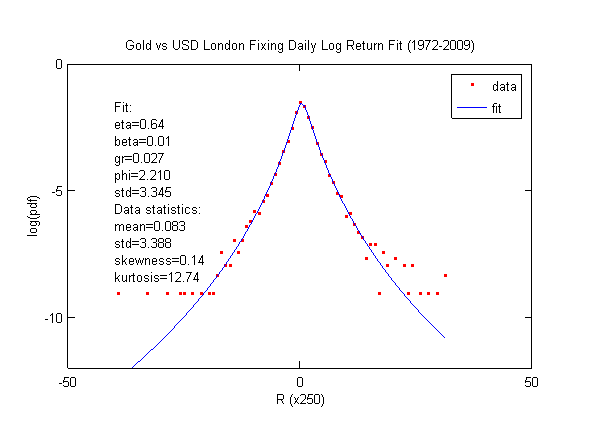

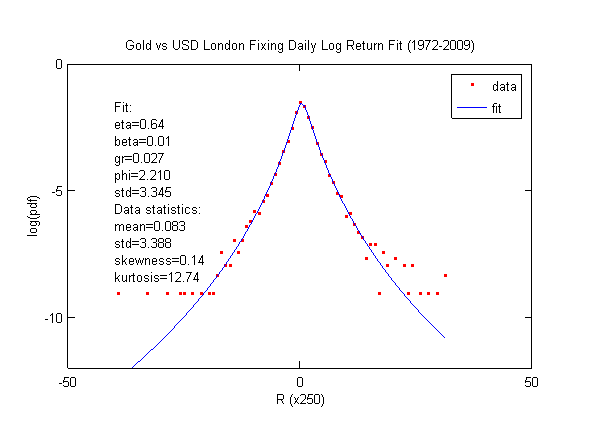

The fit is very accurate. Gold's kurtosis is very large. Notice gold's return is skewed to the positive. Whenever there is volatility, gold moves higher. This is similar to the volatility index VIX, and opposite to Dow. The difference between VIX and gold is that VIX is mean-reverting, while gold is not. The higher prices of gold stick.

The year of 1972 is chosen because Nixon removed gold standard and gold vs USD started to fluctuate in large magnitude.

Gold volatility index is called GVZ. Quotes are displayed on Yahoo ().

CBOE started trading GVZ futures and options in March/April of 2011.